Here are the answers to some of our most frequently asked questions at Insurance Employees Cooperative Credit Union (IECCU).

If you're still having trouble finding what you're looking for and it hasn't been answered here, please contact us.

Yes! If You Are:

There are many differences between banks and credit unions. But the most important is that credit unions are democratically run by the people they serve - their members. Credit unions' primary commitment is to serve their members' financial needs, whereas banks and trust companies exist to earn dividends for shareholders.

A credit union is a co-operative owned and controlled by its members. Each member of a credit union must purchase a share in order to gain membership.

The Hands and Globe logo has symbolic and historic significance for the credit union movement. The cupped hands symbolize both the financial security and support offered by the international credit union network, as well as the fact that the success of the movement is in the hands of its members.

The globe symbolizes the worldwide scope of the movement and suggests the impact that a truly united movement can have on the financial development of all countries. The people within the globe represent the real focus of the credit union movement. It is the human element - the harmony of people working for people - that distinguishes credit unions from other financial institutions.

The Hands and Globe became the official World Council of Credit Unions trademark in 1966, and today it is the recognized credit union symbol in more than 70 countries around the world.

A credit union’s first priority is to serve the needs of its members rather than to make a profit for stockholders. This fundamental difference ensures that credit union profits are reinvested back to the people they belong to, by way of dividends, lower rates and lower service fees. As member owned and governed institutions, this mission is always a top priority for IECCU's management.

Credit unions are community-based and community-focused. At IECCU, we make significant contributions to community events and special projects and play an integral role in local development by reinvesting deposits and profits in the community as personal and business loans, mortgages and dividends paid on Member shares.

Many credit unions offer a wide range of services, similar to banks. Other credit unions have more limited services. All credit unions specialize first and foremost in services for consumers, such as chequeing and savings accounts and personal and consumer loans. IECCU have expanded to include credit and debit cards, home equity loans, and other products and services.

You are not required to change your password. However, you should change your password periodically to enhance security and IECCU reserves the right to require periodic password changes and establish limits on the re-use of passwords.

Provide IECCU with a signed letter stating your desire to terminate your service. The letter may be delivered in person, in the mail, or by fax provided the signature can be verified. IECCU cannot accept notification of cancellation, lost or stolen IDs, passwords or unauthorized transfers via e-mail.

Please contact the IECCU immediately if you notice an error either on the statement or on the online transaction history. The best way is to Contact Member Services at (876)906-5187.

All you need to start is an IECCU account and debit card and a PC with Internet access. In a continued effort to safeguard your information, IECCU requires full 128-bit encryption for Internet Banking use. Hence browsers that offer this highest level of encryption is recommended for Internet Banking use.

If you use an older browser that supports 128-bit encryption, its recommended that you upgrade. Click on your Browser Check to verify that your browser supports 128-bit encryption. If your browser does not support 128-bit encryption, you will need to download the latest version in order for you to use Internet Banking.

There is no special software needed to access Internet Banking. Once you sign up, you will be able to access Internet Banking anytime from IECCU's website.

There is no charge for the basic services of Internet Banking including transaction history and transfers between accounts.

The Credit Union has contracted with a third-party provider for Internet Banking services. That company uses security provided by robust authentication software and enterprise firewalls along with Secure Socket Layer (SSL) encryption. These security features, including multi-factor authentication, protect your identity while making it easy and safe for you to access your account information.

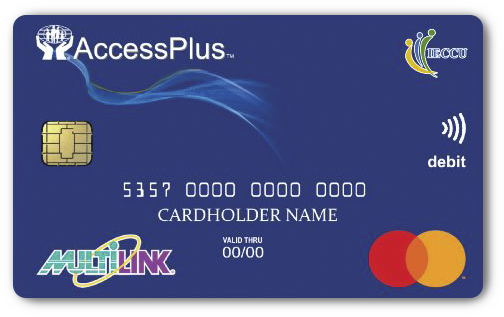

Your Access Plus® Debit Mastercard® has Contactless (Tap & Go) technology so you can enjoy a safer, faster, more convenient way to shop for anything!

Once you enable the contactless functionality of your card, you can pay for your purchases with the wave of your card. It’s the most secure way to pay as your card never has to leave your hand.